China Fund reporter Li Shuchao

Clothing stores that do not invest in are not good listed companies. Last year's performance was down 90% year-on-year. The first quarter of this year's performance forecast has surged by 688%.

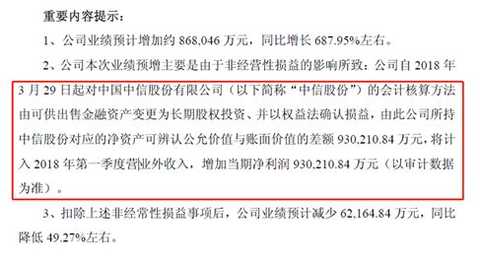

Last night, the well-known clothing brand Youngor 600177, the stock company announced the performance forecast, the first quarter of this year's performance increased by 8.68 billion yuan, a year-on-year increase of 688%. The main reason for the soaring performance is that Youngor’s accounting method for CITIC shares has changed, with a net profit of 9.3 billion yuan. After deducting 620 million yuan from the company’s performance in the month, the first quarter’s performance will be brighter. Eye performance.

This also means that “stock stocks†acted as “fire brigade captains†for Youngor’s downturn, avoiding the company’s performance from deteriorating and changing its face.

|

"Stock stocks" performance contribution

But "returning to the main business of clothing" is the beginning of the heart

Stimulated by good news last night, today's Youngor stock price gapped higher, the intraday share price rose 8.5%, and closed at 6.85%.

|

As a well-known menswear brand, branded clothing, real estate development, and financial investment, Youngor is the three main businesses of the company.

However, from the perspective of the operation of the three major industries, as the investment business is remarkable, the main business of the apparel sector seems to be “off-the-spotâ€. The forecast data for the first quarter report shows:

1. The operating income of the apparel sector was 1.367 billion yuan, an increase of 13.02% over the same period of the previous year; the net profit attributable to shareholders of listed companies was 259 million yuan, an increase of 18.40% over the same period of the previous year.

2. The real estate segment completed operating income of RMB 250 million. Due to the lack of centralized delivery projects in the current period, it decreased by 88.39% compared with the same period of the previous year; the net profit attributable to shareholders of listed companies was RMB 20 million, a decrease of 94.81% over the same period of the previous year.

3. Investment business Due to changes in the accounting method of CITIC Limited, the net profit attributable to shareholders of listed companies was 9.667 billion yuan, an increase of 9.021 billion yuan over the same period of the previous year.

It can be seen from this data that in the quarterly report performance forecast, the net profit contribution ratio of the apparel sector is less than 3%, and the three major sectors are obviously unbalanced.

According to the disclosure data since Youngor's listing, the proportion of clothing and textile traditional business in the company's revenue is also deteriorating. It can maintain a 50% share before 2012. It has been lower than the operating income for three consecutive years since 2014. 30%.

|

In fact, "returning to the main business of clothing" is what Youngor’s chairman Li Rucheng said on different occasions, and his initial heart.

In October last year, when Youngor celebrated the 130th anniversary of the acquisition of the American brand Hartmark, Li Rucheng once said that he now spends 60% of his energy on clothing.

In October 2016, Li Rucheng also proposed a high-profile return to the main business of clothing, and rebuilt a Youngor in five years.

Li Rucheng was 15 years old and went to the Yadu Village of Ningbo Minxian Lighthouse Brigade to "cut the team" to farm. "At that time, I had an idea: to be a tailor, there is a craft, and I will not eat in the future."

Li Rucheng also defended his "initial heart" with practical actions: upgrading the Youngor store, opening 1,000 Youngor's houses with annual sales of more than 10 million yuan in three years; creating five major clothing brands, from clothing manufacturers to brand operators Transformation; launching the high-end political menswear brand “MAYOR†with the world's top five fabric suppliers; with the opportunity to insert the documentary “China in the Bodyâ€, announced that it will unite art craftsmen in various fields in China to build the Youngor House store. For the "Created in China" fashion release platform...

However, with the expansion of Youngor's business, the impression of Youngor in the market has changed from the traditional clothing industry to the big real estate developers and stocks. “Following Youngor to stocks†has once become a joke to the listed companies.

Last year, the Zhongbao reported a total investment of 31 billion yuan.

"Stock stocks" into the main business

Although the company's annual report has not been disclosed, it can be seen from the company's annual report that the company's performance is expected to decrease by about 3.33 billion yuan in 2017, down about 90% year-on-year; Youngor also made a provision for impairment of 3.308 billion yuan on CITIC shares.

Although the annual report has not yet been announced, the investment business disclosed from the company's latest three quarterly report data shows that the company's investment business in the first three quarters achieved an investment income of 2.5 billion yuan, down 14.46% year-on-year; the net profit of investment business was 1.438 billion yuan, down 13% year-on-year. .

The equity of the listed company held by the company includes CITIC Hong Kong stocks, Ningbo Bank 002142, stock bar, Shanghai Pudong Development Bank 600000, stock bar, Jinzhengda 002470, shares, Lianchuang Electronics, entrepreneurial software 300451, stock bar, etc., the total investment cost is 24.071 billion The market value of the third and third quarterly reports was 28.953 billion yuan.

In the middle of last year, Youngor also announced the details of investing in unlisted financial assets and long-term equity investments, including many well-known companies such as China Petroleum Pipeline Company and UnionPay Business Co., Ltd.; and long-term equity investment projects, Ningbo Bank, Zhejiang Companies such as Shangcai Insurance are also on the list.

According to statistics at the time, Youngor invested a total of 31 billion yuan, with a market capitalization of 1.316 billion yuan.

Table 1: Investment projects disclosed by Youngor’s mid-year report

|

Table 2: Long-term equity investment projects reported by Youngor last year

|

Judging from the institutional holdings of Youngor's stock, the Securities Company, Central Huijin and Kunlun Trust are still among the top ten tradable shareholders of the company at the end of the third quarter of last year.

From the data of the public fund holdings of Youngor over the years, in 2004, the proportion of public fund holdings of Youngor reached a high of 24%. At that time, Youngor’s net profit attributable to shareholders of the parent company also reached a high of 39.4%; the shareholding ratio in 2011 was 10%, but all the way down; as of the end of 2017, a total of 185 funds held a total of 59.20 million shares of Youngor, accounting for 1.65% of the current shares. Among them, 99 funds held by Youngor are passive products.

The industry believes that when the listed companies in the traditional industry face the development bottleneck and the market space ceiling, how to continue to develop the main business is also facing greater challenges. As a traditional industry, clothing and textiles also have more room for business expansion under the tide of consumption upgrading, but Youngor’s return to the main business path and implementation effects are still to be observed.

This article was first published on the WeChat public account: China Fund News. The content of the article belongs to the author's personal opinion and does not represent the position of Hexun.com. Investors should act accordingly, at their own risk.

(Editor: Li Jiajia HN153)

Waffle Towels,Waffle Towel Golf,Turkish Towel Waffle,Bath Towel Waffle

Changshu Aijia Knitting Products , https://www.microfiber-lovejoy.com